Reliance Communications Limited and its subsidiary company Reliance Telecom have only 19.34 crore in their combined 144 bank accounts. Companies revealed in an affidavit filed in the Delhi High Court.

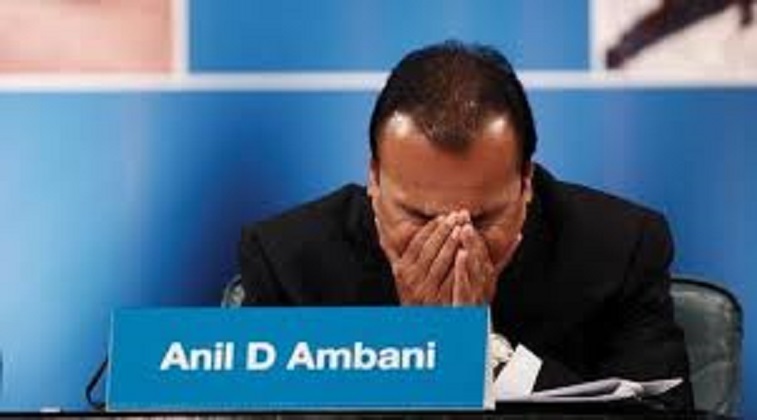

The Anil Ambani-led Company, which shut down its wireless operations last year under the weight of Rs 46,000 crore in debt, slumping revenue and widening losses, revealed its bank holdings in a case filed by American Tower Corp. The Boston-based tower company is said to be seeking dues of almost Rs 230 crore from RCom.

RCom, which narrowly evaded being dragged into bankruptcy proceedings this year, informed the Delhi High Court that it has Rs 17.86 crore in 119 bank accounts, while its subsidiary RTL revealed it has a shade over Rs 1.48 crore across its 25 bank accounts.

Both companies, in affidavits filed in October, sought time from the court to produce their bank statements. The next hearing is on December 13. The tower company’s claims from RCom and RTL “add up to almost Rs 230 crore towards exit fees and service charges”, The payments are for exiting tower lease agreements after RCom stopped wireless services in December.

ATC had moved the Delhi High Court against RCom and RTL in February, seeking a surety for its dues. However, RCom got a Supreme Court stay on November 1 on all payments due to ATC until the apex court hears the matter

The date of the next hearing in the SC isn’t known. Separately, ATC filed contempt proceedings against RCom for non-compliance with a Delhi High Court order dated December 6, 2017, directing the telco to furnish an Rs 88-crore bank guarantee towards exit fees and other dues payable by Sistema Shyam Teleservices, which RCom acquired last year. This matter is under arbitration.

RCom is already involved in various legal battles. The Supreme Court gave it until December 15 to pay Swedish equipment maker Ericsson dues of Rs 550 crore plus interest. Ericsson has filed a contempt petition against RCom chairman Anil Ambani for non-payment of the dues on time, despite a personal guarantee, and the apex court will hear the plea after December 15.

A dispute has also stalled RCom’s efforts to raise over Rs 18,000 crore by selling its wireless assets to Reliance Jio Infocomm and real estate holdings to Brookfield to help repay financial lenders and operational creditors including Ericsson. While it sold switching nodes and its optic fibre network to Jio for Rs 5,000 crore, its spectrum sale has been stuck because the Department of Telecommunications hasn’t approved the plan on account of a dispute over dues.

The department of telecommunications is seeking Rs 2,947.68 crore in bank guarantees from RCom to cover spectrum usage charges. Although the telecom tribunal dismissed the DoT’s pleas for the bank guarantees last month, the department is likely to challenge the order in the Supreme Court, further delaying the RCom-Jio spectrum deal. In its affidavits, RCom revealed that on April 9, 2018, it had a Rs 19.46 crore credit balance in one of its bank accounts, which was transferred to a trust and retention account maintained by SBI.

The money in this account, it said, was used to pay the DoT fees for extending the validity of various bank guarantees for spectrum and licence. Payments from this account are audited by RCom’s lenders before any money is released by SBI, it said.

Post Your Comments