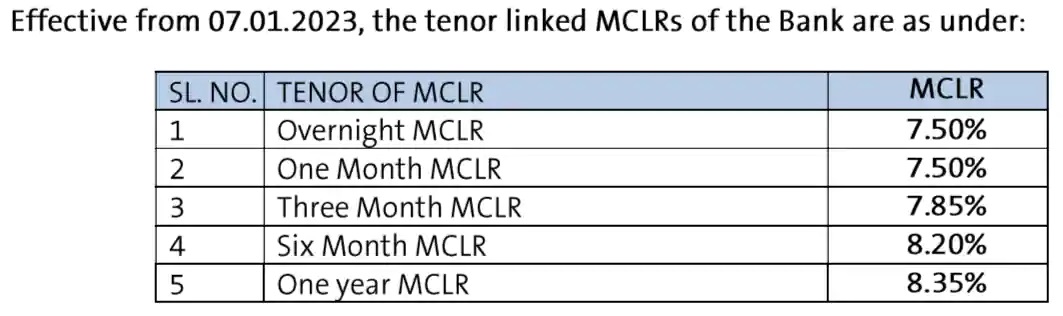

Mumbai: Leading public sector bank in the country, Canara Bank hiked lending rates across tenures by 15 to 25 bps. The overnight to 1 month Marginal Cost of Funds Based Lending Rate (MCLR) is now at 7.50%, 3 month MCLR is 7.85%, six month MCLR is 8.20% and the 1 year MCLR is 8.35%.

‘The above MCLRs shall be applicable only to new loans/advances sanctioned/first disbursement made on or after 07.01.2023 and those credit facilities renewed / reviewed / reset undertaken and where switchover to MCLR linked interest rate is permitted at the option of the borrower, on or after 07.01.2023. The above MCLRs will be effective till next review. Existing borrowers of the Bank shall have an option to switch over to interest rates linked to MCLR (other than Fixed Rate Loans). Borrowers willing to switch over to the MCLR based interest rate may contact the branch,’ said Canara Bank in a statement.

Also Read: Saudi Arabia opens Hajj registration

MCLR is the minimum rate of interest banks are allowed to give out loans to its customers. It is a benchmark interest rate and it dictates the lower limit of the interest rate for a loan.

Post Your Comments