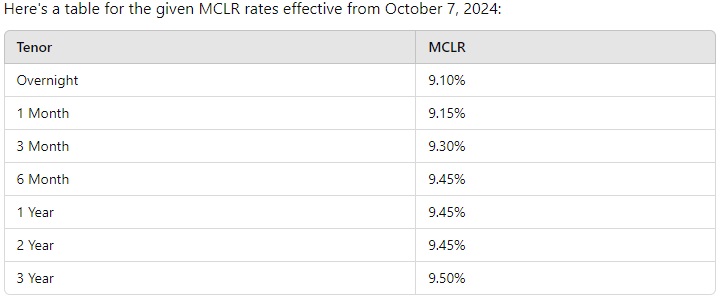

Mumbai: Leading private sector bank in the country, HDFC Bank has raised its marginal cost of funds-based lending rates (MCLR). The lending rates were hiked by up to 5 basis points (bps) for certain tenure. The new MCLR rates now range from 9.10% to 9.50.

All lending rates at HDFC Bank are tied to the policy repo rate, currently set at 6.50%. The adjustment impacts the six-month and three-year tenures, with the six-month MCLR increasing from 9.40% to 9.45%.

The one-year MCLR, a key benchmark for various consumer loans, remains unchanged at 9.45%. Meanwhile, the three-year MCLR has risen from 9.45% to 9.50%. The two-year MCLR stays steady at 9.45%. Additional rates include 9.10% for overnight loans, 9.15% for one-month loans, and 9.30% for three-month loans.

Also Read: UAE authority announces new bus service to Global Village: Details

MCLR, which was introduced by the Reserve Bank of India (RBI) in 2016, is a benchmark interest rate set by the RBI that banks use to determine their lending rates. Banks cannot give loans below this rate. When MCLR increases, it leads to higher interest rates on loans linked to this rate, causing borrowers to face higher EMIs and increased overall borrowing costs.

HDFC Bank earlier in last week said that it has registered a 7% rise in loans to Rs 25.19 lakh crore in the second quarter of this fiscal. The credit book was Rs 23.54 lakh crore as of September 30 last year.

During the quarter that ended September 30, 2024, the Bank securitised/assigned loans of Rs 19,200 crore (year to date Rs 24,600 crore) as a strategic initiative, HDFC Bank said in a regulatory filing. The Bank’s average deposits were Rs 23.53 lakh crore for the September 2024 quarter, a growth of around 15.4% against Rs 20.38 lakh crore for the September 2023 quarter, it said. Liquidity coverage ratio (average) was around 127% for the quarter, it added.

Post Your Comments