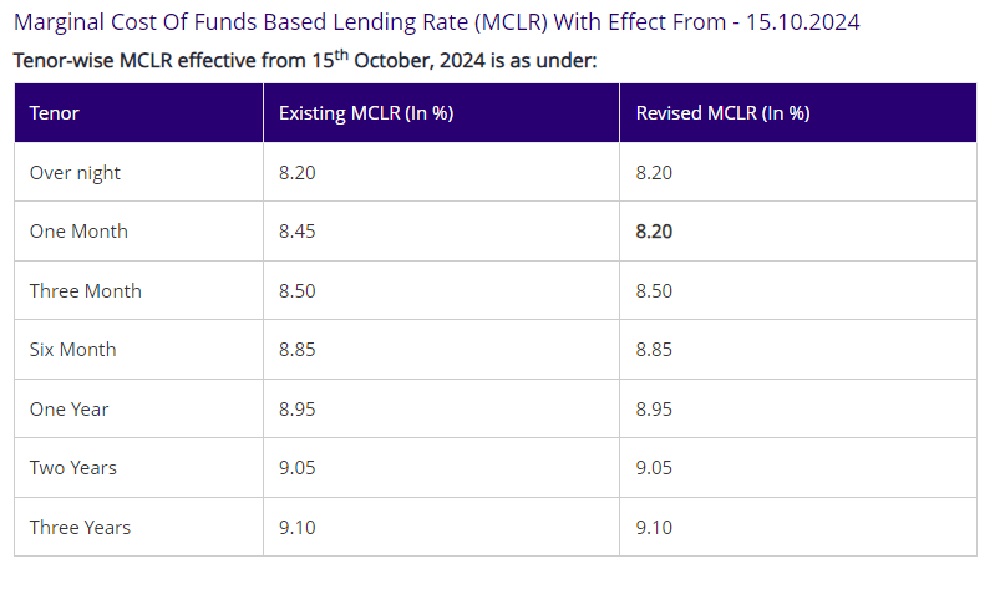

Mumbai: Largest bank in the country, State Bank of India (SBI), has reduced the marginal cost of funds-based lending rate (MCLR). The public sector bank slashed the MCLR by 25 basis points (bps) for one-month tenure. This will make short-term loans, like personal loans, car loans and working capital loans, cheaper for SBI borrowers.

One-month MCLR has been slashed from 8.45 per cent to 8.20 per cent. However, MCLR on other tenures remains the same. MCLR rate remains 8.2 per cent for overnight, 8.50 per cent for three-month tenure, 8.85 per cent for six months, 8.95 per cent for benchmark one-year tenure, 9.05 per cent for two years, and 9.10 per cent for three years.

Also Read: Reliance Jio launches new 4G feature phones in India: Price, Features

MCLR was introduced by the Reserve Bank of India (RBI) in 2016. MCLR, or Marginal Cost of Funds-based Lending Rate, is a benchmark interest rate set by the RBI that banks use to determine their lending rates. Banks cannot give loans below this rate. When MCLR increases, it leads to higher interest rates on loans linked to this rate, causing borrowers to face higher EMIs and increased overall borrowing costs. When MCLR goes down, loan interest rates can also decrease, making loans cheaper for borrowers.

Post Your Comments